Removing the Political Opponent Means Diminishing What's Remaining of Turkey's Economy.

Turkey is currently facing a crisis instigated by the detention of Istanbul Mayor Ekrem İmamoğlu, occurring at a notably delicate time—right when Finance Minister Mehmet Şimşek and the Central Bank had successfully started to tame inflation and were carefully lowering interest rates. Nevertheless, the court's recent ruling to prolong İmamoğlu's detention until his trial has sparked renewed unrest, jeopardizing economic stability and shaking investor confidence.

The recent arrest of İmamoğlu, along with several associates, last Thursday under accusations of "corruption and aiding terrorism," sent a seismic jolt through Turkey's already delicate markets. This turmoil was immediately reflected in a sharp market response: the Istanbul Stock Exchange plummeted nearly 8% within hours, wiping out billions in market capitalization. At the same time, the Turkish lira reached record lows against the euro and the U.S. dollar, highlighting investor anxiety and waning confidence.

Only a robust intervention by the Central Bank, which involved injecting around $8-10 billion from its foreign currency reserves, managed to prevent an even steeper decline in the currency’s value. Although this helped stabilize the lira momentarily, such measures have limited effectiveness; despite having approximately $60 billion in reserves, persistent political instability could swiftly deplete these buffers, leaving the economy highly vulnerable.

By Friday, the markets showed tentative signs of recovery, posting a modest 2% uptick, followed by gains of over 3% noted on Monday morning. Nonetheless, analysts warn against reading too much into this limited rebound as an indication of sustainable stability. The court’s decision on Sunday to keep İmamoğlu in custody until his trial highlights President Recep Tayyip Erdoğan’s relentless drive to politically neutralize his most significant rival, who is widely expected to challenge Erdoğan in the crucial 2028 elections.

Political Oppression Fuels Nationwide Protests

Ekrem İmamoğlu is not just any political leader; his charismatic presence cuts across traditional party lines, greatly enlarging his support base. Therefore, his arrest has sparked an immediate and formidable backlash, resulting in significant protests across Istanbul, Ankara, Izmir, and other major cities. Erdoğan’s adversaries perceive the charges as overtly political, driven solely by Erdoğan's desire to fortify his power ahead of upcoming electoral contests.

Istanbul has quickly spiraled into disarray due to the ongoing street demonstrations, leading to serious disruptions in transportation. Authorities have implemented restrictions, including numerous roadblocks and traffic rerouting, exacerbating issues in public transport and affecting businesses. This chaos extends beyond mere inconvenience for residents; it substantially impacts small enterprises, service sectors, and overall productivity, worsening economic instability.

Immediate Economic Repercussions and Investor Sentiment

The implications of İmamoğlu’s high-profile arrest incited rapid responses from international investors and major financial institutions. JPMorgan promptly adjusted its economic forecast for Turkey, raising its year-end inflation prediction from 27.2% to 29.5%. Similarly,JPMorgan now anticipates Turkish interest rates will rise to 35% by year’s end, a significant increase from the earlier expectation of 30%. These changes signal a clear decline in investor confidence regarding Turkey's short- to medium-term economic stability.

This political and economic turmoil comes at an especially fragile juncture. After wrapping up 2024 with inflation around 40%, a significant drop from 75% the year before, Turkey’s Central Bank had cautiously begun a series of gradual interest rate cuts. These reductions, carefully managed by Finance Minister Mehmet Şimşek, marked Turkey's nascent emergence from a protracted recession that afflicted much of 2024. Last year's GDP growth rate of 3.2%, including a strong last-quarter increase of 3%, seemed to herald a slow economic recovery.

However, the sudden political instability triggered by İmamoğlu's arrest threatens to undermine these fragile gains. Continued market fluctuations could reverse the recent progress, rapidly dismantling months of careful policymaking by the Finance Ministry and Central Bank.

Erdoğan's Resolve and Geopolitical Ramifications

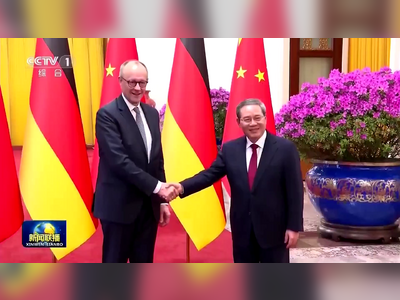

President Erdoğan's steadfast determination to eliminate potential political threats ahead of upcoming elections is increasingly apparent. While such strategies may serve short-term political goals, they concurrently compromise Turkey’s international image, economic prospects, and diplomatic strength. Observers express concern that ongoing authoritarian tactics could further alienate Turkey on the global stage, restrict access to foreign capital markets, and complicate crucial international discussions, particularly with key allies in Europe and the U.S.

Additionally, the recent arrests strain already tenuous relations with the European Union, casting doubt on Turkey’s long-term economic partnership prospects, including vital trade agreements and foreign direct investments. The European Parliament and U.S. Congress have previously raised serious concerns regarding Turkey’s democratic backsliding, and these latest developments are bound to heighten those criticisms.

Foreign Investors’ Concerns and Risks of Capital Exodus

The arrests have intensified uncertainties for foreign investors, driving substantial shifts away from Turkish assets toward safer alternatives like gold and U.S. dollars. Analysts predict sustained downward pressure on the lira, which could lead to ongoing depreciation. A prolonged 10% annual decline in the Turkish lira, akin to recent short-term drops, could raise inflation rates by around 5% annually, complicating Turkey's battle against rising prices.

Foreign investors, already cautious due to past currency crises and political instability, might hasten their capital flight. Such an exodus would inflict deep, lasting harm on Turkey’s fiscal stability, reducing foreign direct investment that is crucial for sustainable economic development.

Interest Rate Strategy Under Growing Pressure

Amid this backdrop of heightened political and economic volatility, questions remain about the Central Bank’s forthcoming policy decisions. Since December 2024, the Central Bank has lowered interest rates three times in succession, encouraged by earlier signs of inflation easing. Currently, Turkey’s benchmark interest rate is at 42.5%, down from 50% at the end of 2024.

Given the renewed inflationary pressures alongside ongoing political turmoil, the Central Bank may find it necessary to reverse its recent rate cuts. However, Finance Minister Şimşek continues to assert his commitment to cautious rate reductions. While he acknowledges the current challenges, he insists on adhering to his planned course, seeking a balance between controlling inflation and stimulating growth.

Despite this stance, market responses could ultimately dictate policy shifts, forcing the Central Bank to reassess its approach. Analysts speculate that the Bank might need to pause any further planned rate cuts in the near term, taking a more cautious, reactive stance to navigate the economic uncertainties spawned by political instability.

Conclusion and Future Outlook

The ongoing political crisis surrounding Ekrem İmamoğlu’s detention poses significant risks to Turkey's economic future. While Erdoğan may achieve his immediate political aims by sidelining key rivals, the longer-term repercussions—escalating inflation, capital flight, and waning investor confidence—could severely undermine the country's overall economic stability and standing in the global arena.

Investors and policymakers must remain alert for continued volatility, closely tracking key indicators such as currency fluctuations, inflation metrics, investor sentiment, and governmental policy announcements. Ultimately, establishing political stability and measures to rebuild confidence will be vital for Turkey’s long-term economic recovery and sustainability.

Without prompt corrective actions and efforts toward political reconciliation, Turkey risks considerable economic decline, potentially sacrificing years of hard-fought progress for the sake of short-term political aspirations.

Only a robust intervention by the Central Bank, which involved injecting around $8-10 billion from its foreign currency reserves, managed to prevent an even steeper decline in the currency’s value. Although this helped stabilize the lira momentarily, such measures have limited effectiveness; despite having approximately $60 billion in reserves, persistent political instability could swiftly deplete these buffers, leaving the economy highly vulnerable.

By Friday, the markets showed tentative signs of recovery, posting a modest 2% uptick, followed by gains of over 3% noted on Monday morning. Nonetheless, analysts warn against reading too much into this limited rebound as an indication of sustainable stability. The court’s decision on Sunday to keep İmamoğlu in custody until his trial highlights President Recep Tayyip Erdoğan’s relentless drive to politically neutralize his most significant rival, who is widely expected to challenge Erdoğan in the crucial 2028 elections.

Political Oppression Fuels Nationwide Protests

Ekrem İmamoğlu is not just any political leader; his charismatic presence cuts across traditional party lines, greatly enlarging his support base. Therefore, his arrest has sparked an immediate and formidable backlash, resulting in significant protests across Istanbul, Ankara, Izmir, and other major cities. Erdoğan’s adversaries perceive the charges as overtly political, driven solely by Erdoğan's desire to fortify his power ahead of upcoming electoral contests.

Istanbul has quickly spiraled into disarray due to the ongoing street demonstrations, leading to serious disruptions in transportation. Authorities have implemented restrictions, including numerous roadblocks and traffic rerouting, exacerbating issues in public transport and affecting businesses. This chaos extends beyond mere inconvenience for residents; it substantially impacts small enterprises, service sectors, and overall productivity, worsening economic instability.

Immediate Economic Repercussions and Investor Sentiment

The implications of İmamoğlu’s high-profile arrest incited rapid responses from international investors and major financial institutions. JPMorgan promptly adjusted its economic forecast for Turkey, raising its year-end inflation prediction from 27.2% to 29.5%. Similarly,JPMorgan now anticipates Turkish interest rates will rise to 35% by year’s end, a significant increase from the earlier expectation of 30%. These changes signal a clear decline in investor confidence regarding Turkey's short- to medium-term economic stability.

This political and economic turmoil comes at an especially fragile juncture. After wrapping up 2024 with inflation around 40%, a significant drop from 75% the year before, Turkey’s Central Bank had cautiously begun a series of gradual interest rate cuts. These reductions, carefully managed by Finance Minister Mehmet Şimşek, marked Turkey's nascent emergence from a protracted recession that afflicted much of 2024. Last year's GDP growth rate of 3.2%, including a strong last-quarter increase of 3%, seemed to herald a slow economic recovery.

However, the sudden political instability triggered by İmamoğlu's arrest threatens to undermine these fragile gains. Continued market fluctuations could reverse the recent progress, rapidly dismantling months of careful policymaking by the Finance Ministry and Central Bank.

Erdoğan's Resolve and Geopolitical Ramifications

President Erdoğan's steadfast determination to eliminate potential political threats ahead of upcoming elections is increasingly apparent. While such strategies may serve short-term political goals, they concurrently compromise Turkey’s international image, economic prospects, and diplomatic strength. Observers express concern that ongoing authoritarian tactics could further alienate Turkey on the global stage, restrict access to foreign capital markets, and complicate crucial international discussions, particularly with key allies in Europe and the U.S.

Additionally, the recent arrests strain already tenuous relations with the European Union, casting doubt on Turkey’s long-term economic partnership prospects, including vital trade agreements and foreign direct investments. The European Parliament and U.S. Congress have previously raised serious concerns regarding Turkey’s democratic backsliding, and these latest developments are bound to heighten those criticisms.

Foreign Investors’ Concerns and Risks of Capital Exodus

The arrests have intensified uncertainties for foreign investors, driving substantial shifts away from Turkish assets toward safer alternatives like gold and U.S. dollars. Analysts predict sustained downward pressure on the lira, which could lead to ongoing depreciation. A prolonged 10% annual decline in the Turkish lira, akin to recent short-term drops, could raise inflation rates by around 5% annually, complicating Turkey's battle against rising prices.

Foreign investors, already cautious due to past currency crises and political instability, might hasten their capital flight. Such an exodus would inflict deep, lasting harm on Turkey’s fiscal stability, reducing foreign direct investment that is crucial for sustainable economic development.

Interest Rate Strategy Under Growing Pressure

Amid this backdrop of heightened political and economic volatility, questions remain about the Central Bank’s forthcoming policy decisions. Since December 2024, the Central Bank has lowered interest rates three times in succession, encouraged by earlier signs of inflation easing. Currently, Turkey’s benchmark interest rate is at 42.5%, down from 50% at the end of 2024.

Given the renewed inflationary pressures alongside ongoing political turmoil, the Central Bank may find it necessary to reverse its recent rate cuts. However, Finance Minister Şimşek continues to assert his commitment to cautious rate reductions. While he acknowledges the current challenges, he insists on adhering to his planned course, seeking a balance between controlling inflation and stimulating growth.

Despite this stance, market responses could ultimately dictate policy shifts, forcing the Central Bank to reassess its approach. Analysts speculate that the Bank might need to pause any further planned rate cuts in the near term, taking a more cautious, reactive stance to navigate the economic uncertainties spawned by political instability.

Conclusion and Future Outlook

The ongoing political crisis surrounding Ekrem İmamoğlu’s detention poses significant risks to Turkey's economic future. While Erdoğan may achieve his immediate political aims by sidelining key rivals, the longer-term repercussions—escalating inflation, capital flight, and waning investor confidence—could severely undermine the country's overall economic stability and standing in the global arena.

Investors and policymakers must remain alert for continued volatility, closely tracking key indicators such as currency fluctuations, inflation metrics, investor sentiment, and governmental policy announcements. Ultimately, establishing political stability and measures to rebuild confidence will be vital for Turkey’s long-term economic recovery and sustainability.

Without prompt corrective actions and efforts toward political reconciliation, Turkey risks considerable economic decline, potentially sacrificing years of hard-fought progress for the sake of short-term political aspirations.

AI Disclaimer: An advanced artificial intelligence (AI) system generated the content of this page on its own. This innovative technology conducts extensive research from a variety of reliable sources, performs rigorous fact-checking and verification, cleans up and balances biased or manipulated content, and presents a minimal factual summary that is just enough yet essential for you to function as an informed and educated citizen. Please keep in mind, however, that this system is an evolving technology, and as a result, the article may contain accidental inaccuracies or errors. We urge you to help us improve our site by reporting any inaccuracies you find using the "Contact Us" link at the bottom of this page. Your helpful feedback helps us improve our system and deliver more precise content. When you find an article of interest here, please look for the full and extensive coverage of this topic in traditional news sources, as they are written by professional journalists that we try to support, not replace. We appreciate your understanding and assistance.